Call Us Today! • 888-501-0530

Buying Burial Insurance for Your Parents

Buying Burial Insurance for Your Parents

Although buying burial insurance (term or permanent) for your parent’s final expenses is not something you might look forward to, it might be necessary if they have not taken care of this already. Make sure your parents have an insurance plan in place, this can alleviate some of your worries about taking care of the burial and final expenses.

If your parents still have outstanding debts, a burial insurance plan will also help guarantee the family can take care of the obligations upon their death.

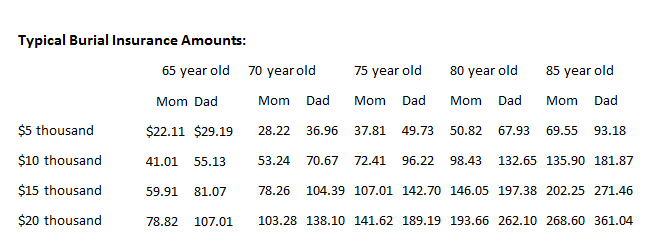

Typical Burial Insurance Amounts:

Can You Get a Burial Insurance Plan On Your Parents?

When it comes to buying burial insurance for your parents, you will have to show the insurance company what is known as “insurable interest.” This simply means that you will suffer some kind of financial loss if your parents’ were to pass away.

As you can probably guess It is not difficult for adult children to show an insurable interest when it comes to insuring their parents with a burial insurance plan.. At BurialInsurancePlans.org we hear the question all the time: Can I be the owner of my parent’s burial insurance plan and the beneficiary? The answer is yes, as long as you will be in charge of handling your parent’s final expense. No documentation of this is required, some insurance applications simply as if you have an insurable interest in the life of the Insured.

Once this has been established, you will then need to determine the amount of coverage that will be necessary. The type of coverage required will also have to be defined. What kind of burial insurance coverage will best serve your family’s needs and those of your parents?

CLICK HERE to get Quotes on Burial Insurance Plans for your Parents!

What Type of Insurance To Choose for my Parents?

With Burial Insurance, you can choose from permanent insurance or level term burial insurance. With standard term insurance your elderly parent (mom or dad) will only be covered for a set period ex. 5, 10, or 15 years. With a permanent burial plan, on the other hand, the coverage lasts throughout the remainder of your parent’s life. Permanent burial insurance is not as affordable as term insurance.

Besides, if your parents are quite old, term life insurance may not be available to purchase beyond the life expectancies of your parents. In our professional opinion, one is definitely a better choice than the other –for a well-built Burial Insurance Plan permanent burial insurance is the only way to go. Although this may be true in most cases, it is a very personal decision that must be based on your unique circumstances.

How Much Coverage to Buy for my Parents?

The amount of burial insurance coverage you need also depends on the overall purpose of the plan. If you are simply looking to have the funeral and final expenses covered, an insurance plan with a small payout of around $10,000 to $15,000 may be sufficient for your family’s needs.

On the other hand, you may need a more extensive plan that could be used in case of medical costs, or that will help pay off additional expenses in the event of your parent’s passing, an example, would be estate taxes.

Click Here to learn if your Mother or Father qualify for a policy.

How Much Would Burial Insurance Cost For My Parents?

Costs will vary depending on your parent’s health, plan, and age. Obviously, younger they are, the cheaper the plan will be. Also, if there are health problems like high blood pressure (hypertension), diabetes, heart disease, or have had cancer, overweight, and many more conditions, the average cost of coverage will be higher.

Here we have a few average quotes for a burial insurance plan for a few elderly women, non-smoker, in good health:

Example rates as of 5/6/2019 – your prices will vary.

This is just a guide – the Burial Insurance provider will determine if you are approved based on your current health issues.

Click here for more burial insurance quotes.

Buying Burial Insurance For My Father

Thinking of buying a Burial Insurance Plan on your Father, however, you’re not sure if you could, or how to go about doing it? At Burial Insurance Plans we can help you with all your questions and help find the best possible rates.

One thing you will notice when shopping for a burial insurance plan for your Father is that insurance is more expensive for men than it is for Women of the same age and amount of coverage. If you look at almost any burial insurance premium chart, one thing will immediately be apparent, burial insurance is more expensive for men than for women.

Men Live Shorter Life Spans On Average

The average American woman lives around 5 years longer than the average US male so the Burial Insurance company will have to pay the claim sooner. This fact is the primary reason why when buying Burial Insurance on your Father it will cost more. Since males are expected to live shorter lives than women the insurance company will have to charge more in premiums to cover the risk by charging higher premiums.

Buying Burial Insurance For My Mother

Buying a Burial insurance policy for your Mother is not a pleasant task. Although, it may be a necessary thing to do for your family. Possibly you will need to pay estate taxes with your Mother’s passing or pay for burial expenses. Often times our mothers are the last of our parents to pass; as a result, the kids are more often the ones to make all the final arrangements. No matter the reason, at burial insurance plans we make it easy to compare rates from many different insurance companies.

Does My Mother Have A Burial Insurance Plan?

We get this question a lot from the family’s that we talk to, it’s usually as a result of another family member passing away like the Father or an aunt or uncle that didn’t have a burial insurance plan. We see a lot of times that the Father has an insurance plan, but the Mother does not have burial insurance. Sometimes this is due to the fact in the past more Men were the primary income providers. Some companies provide a permanent insurance plan that can be used for burial insurance when they retire. If your Mother didn’t work outside the home as much, this could be the case. Nonetheless, a burial insurance plan for your Mother is, and they don’t seem to get the insurance on their own.

Sometimes our mothers think they don’t need burial insurance because they have enough savings on hand. We find this excuse very dangerous because often times by the time they grow old and start to run out of money it is too late. Buying burial insurance can be difficult after age 85, due to age and or significant health issues that have come into play at that time making it incredibly hard to find coverage. If your Father took care of the financials in the home, some mothers have a hard time trusting insurance companies. As a result, they don’t know who to trust and never get around to making the purchase. Maybe your Mother just thought it was not something she wanted to think about. Perhaps it was just too creepy to think about. It’s a fact that 100% of our parents will die one day and only 52% will have some form of insurance in place to pay for the final expenses.

Can I Pay For Burial Insurance For My Parents?

Your parents might not be able to afford it on their own. So often the children of parents want to pay for the premiums themselves. This is accomplishes two things; they know the burial insurance plan is in place and the premiums will be paid. This is the only way to be sure the policy is around when you need it.

Once the system is in force, it is essential that the premiums be continued. If your parents were to stop making payments, the policy would also stop, and your family would not receive the death benefits.

Is Guaranteed Burial Insurance Available For My Parents?

“Guaranteed burial insurance” or “no medical exam final expense,” or even “no questions asked” – they are all referring to the same thing.

This is a guaranteed issue burial insurance plan that will be issued. This policy will be issued in all cases, even with significant health issues your parents may have or had in the past. There are two significant problems with these plans; one is, the premiums will be much higher and the death benefit lower – usually $5,000 to $25,000 thousand.

The second problem is these plans have a 2-year waiting period. This means that even if you start the program and make the first premium payment today, the death benefit will not be fully paid till after the 24th premium payment. If your parents pass away before the 24 months are up the full death benefit will not be paid. You will in most cases only get back premiums paid with interest.

It’s the most common policy advertised on tv and issued to elderly people. Its often marketed directly in the mail and is promoted to pay for expenses like funeral expenses, medical bills, or other outstanding debts. AIG Burial Insurance and Mutual of Omaha are only two of these examples.

Are My Parents Too Old For Burial Insurance?

Can I still get burial insurance if my parents are over 80? It doesn’t matter if your parents are over 60, 70, 80, or even over 85 years old. It is still easy to insure them if they don’t suffer any major health issues.

Some of the health issues that may prevent burial insurance from being approved…

- Heart attacks in the last two years

- Currently under treatment for cancer

- Heart bypass surgery in the past 2 years

Of course, if they are closer to 85 than 65, it won’t be as easy on the pocketbook. As with all insurance the older they are when you apply, the more expensive it will be. So today is always better than tomorrow, and some insurance is better than none.

Sorry, comments are closed for this post.